Annual adjustments will vary

Prior to the 2018 tax year, inflation adjustments for things such as tax brackets, standard deductions, and other tax provisions were based on the CPI-U (Consumer Price Index for all urban consumers). This index tracks a basket of goods and services that affect specific U.S. households, so it makes sense that it was used to gradually increase tax-related figures over time.

The new tax law instead uses a metric known as chained CPI, which creates the assumption that if a particular good or service becomes too expensive, consumers will start to buy a cheaper alternative. Without getting too deep into the discussion about the chained CPI, the effect is that the index increases at a slightly slower rate over time than other forms of CPI.

This is a relatively subtle change and is unlikely to have a major impact on a year-to-year basis. However, because the jagged CPI grows slowly over time, it can have a major impact on the adjustment of inflation to the tax code for decades. Simply put, its long-term effect means that the higher tax bracket will begin to apply to low-income taxpayers, as real inflation will (theoretically) grow faster than the marginal tax bracket's income threshold.

High standard deduction

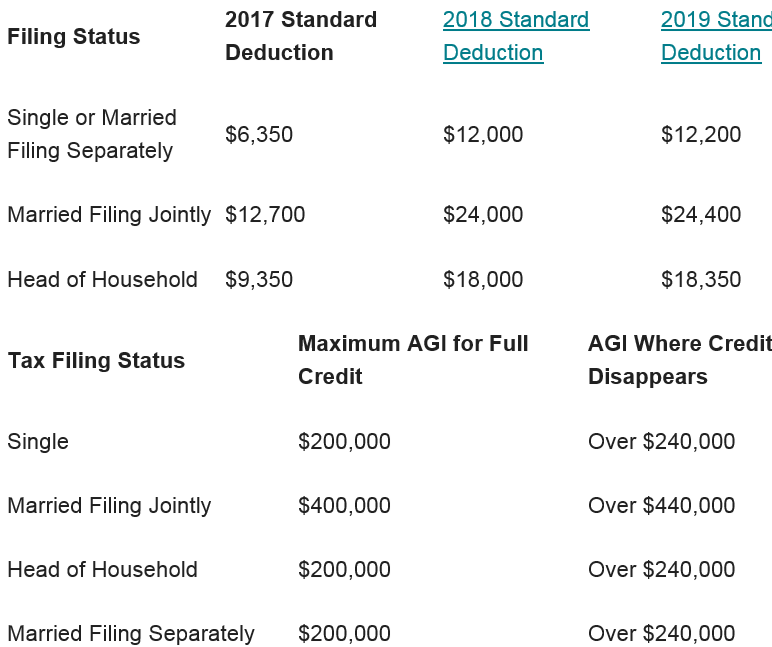

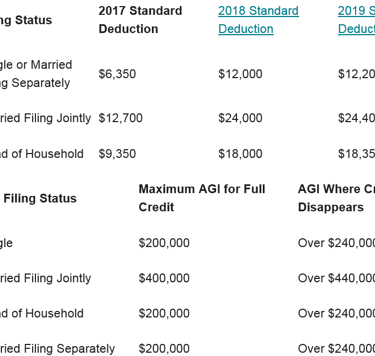

The Tax Cuts and Jobs Act almost doubled the standard deduction from previous levels. Taxpayers can choose between using the standard deduction or itemized deduction. Itemizing deductions means adding all the personal tax deductions you are entitled to and then subtracting them from your adjusted gross income (AGM). (Note: Adjusted gross income is some adjustment minus your total income. Common adjustments to income include traditional IRA contributions and student loan interest, just to name a few.)

On the other hand, the standard deduction is simply a set amount that Americans can choose to deduct instead. Which of the two methods taxpayers can use is more beneficial for them.

Most families in the US use the standard deduction, so this change will certainly affect millions of people.

With this in mind, here is a comparison of the standard deduction applicable for the 2017 tax year and for 2018 and 2019:

Most education tax breaks remain

Two popular tax credits for college spending, the American Opportunity Credit and the Lifetime Learning Credit, both survived tax reform. These are designed to reduce the tax bills of people paying college tuition. The American Opportunity Credit applies to tuition paid toward a degree or certificate program, but only for the first four years of college, while the Lifetime Learning Credit applies to almost all tuition and fees.

However, it is worth noting that the tuition and fees tax deduction is no longer available, as the 2018 Bipartisan Budget Act only made it available through the 2017 tax year - although it is possible that Congress will still choose to extend it . Previously, some taxpayers who could not qualify for one of the two credits could deduct as much as $ 4,000 tuition and fees as an adjustment to income. Now, taxpayers who cannot qualify for credit are out of luck.

529 Extended Use of Savings Schemes

The two main college savings accounts, 529 savings plans and the Coverdale Education Savings Account, or ESAS, both remain in the revised tax code. These accounts provide an after-tax facility for parents and other relatives to save and invest money for educational expenses such as tuition, fees, books and some other eligible expenses. While there is no deduction for contributions to these accounts on federal tax returns, any money from investments in these accounts can be withdrawn tax-free if used for qualified expenses.

However, 529 savings schemes were changed to allow the use of funds for educational expenses at any level, not just for the college. This was already the case with Coverdale ESA. As a possible example, if you send your child to a private high school, you can potentially use the money from their 529 savings plan to help pay for it.

Mortgage interest is still deductible, but…

The deduction for mortgage interest is one of the most popular US tax breaks. In fact, such tax benefits are often a primary reason Americans decide to buy a home. Fortunately, for many homeowners, the mortgage reform deduction survived tax reform efforts, but it received two major amendments.

First, the cap (or limit) on the total deduction is deductible on interest up to $ 750,000 of eligible housing loans, or the mortgage principal on a primary or secondary home. This is below the previous limit of $ 1 million, although mortgages received before December 15, 2017 are grandfathered to a higher limit.

Second, the previous excess limit that allowed taxpayers to deduct interest on more than $ 100,000 of home equity loans. To be clear, interest on a home equity loan (such as HELOC) can still be used as a deduction, but only if and if the loan was used to improve your home. In this case, it becomes an eligible residence loan and is counted as part of your $ 750,000 cap.

Charitable contribution

The charitable contribution deduction is another wildly popular tax break and it never actually happened. In fact, highly charitable taxpayers can now cut donations by more than 60% of their AGI - a maximum increase from the previous 50%.

However, a possible negative change is that regular donations made to colleges and universities in exchange for the right to purchase athletic tickets are no longer volatile.

Medical expenditure cuts for 2018 are small, but…

The Tax Cuts and Jobs Act reduced the threshold for deductions in medical expenses from the AGI's prior limit of 7.5% to 10%. In other words, taxpayers with an AGI of $ 100,000 can now deduct more than $ 7,500 in medical expenses. The IRS has a long list of expenses that qualify as "medical expenses", so it might be a good idea to start taking care of you if you think you might qualify.

However, this change was made only for the 2017 and 2018 tax years. So you will be able to take advantage of this on the tax return you filed in 2019. Apart from that time, however, there is a readiness to raise the limit again to 10% until Congress works to increase it.

SALT Deduction: High Tax is Bad News for States

The largest tax deduction by the dollar amount that Americans have taken advantage of in recent years is the deduction for state and local taxes - also known as the SALT (state and local tax) deduction. In particular, Americans are able to make the following cuts:

State and / or local property taxes, such as those paid on personal residence, automobiles, or other personal property.

State and local income tax or state sales tax, whichever is the result of large deductions. Generally, income tax reductions are preferable, but the option to cut sales tax allows residents of states without income tax to benefit. If you choose the sales tax option, you do not need receipts - the IRS provides a calculator to determine this deduction.

Starting with the 2018 tax year, however, the SALT deduction is limited to a total of $ 10,000. This may sound like a lot, but many Americans - especially in high-tax states like New York, New Jersey and California - have had this amount cut several times. For example, property taxes on my parents' modest home in New Jersey reach about $ 10,000.

Now, millions of Americans cannot cut their state and local taxes, and on top of that, the higher standard deduction means that many families who pay state and local taxes in greater amounts will probably take advantage of the SALT deduction. Not be able to

No more Obamacare punishments starting in 2019

Although the Republican administration and Congress have thus failed to repeal the Affordable Care Act, the Tax Cuts and Jobs Act overturned a separate mandate - the "Obamacare Penalty". This is the penalty you pay for not getting health insurance.

An important caveat: Fines are revoked only in the tax year 2019 and beyond. If you have not improved health coverage in 2018, you may still face a penalty when filing tax returns in 2019.

New pass-income deduction

Created as a tax break for small business owners, the Tax Deductions and Jobs Act includes a 20% deduction for "pass-through" income. This includes income from a sole proprietorship or other pass-through entities such as Partnerships, LLCs, and S-Core. Real estate income matters, as do the dividends you receive from REIT (Real Estate Investment Trust) shares.

There is a notable restriction. The new law sets the maximum amount of income people in "professional services" businesses, such as lawyers, doctors and consultants, can earn by taking advantage of deductions. For the 2018 tax year, the pass-through deduction for these types of business starts at an AGI with a phase in excess of $ 157,500 (single filer) or $ 315,000 (jointly married filing).

Major Changes in Alternative Minimum Tax

Many legislators initially demanded repeal of the Alternative Minimum Tax or AMT, but it still exists in 2018 and beyond. If you are not familiar with this, AMT is designed to ensure that high-income taxpayers pay their fair share of taxes, even if they are entitled to a ton of deductions and credits.

Taxpayers still need to calculate their taxes twice - once under the standard method and again using AMT - and whichever results in a larger bill. However, don't worry - your tax-preparation software program will determine that you need to be concerned about AMT. However, some important changes were made by the new tax law.

First, the AMT exemption was never indexed to inflation. This became the main problem with AMT - as it did not change over time with purchasing power, it began to apply to more and more Americans. AMT was never created to influence the middle class, but it started doing so. From here, the AMT exemption amount will be indexed for inflation.

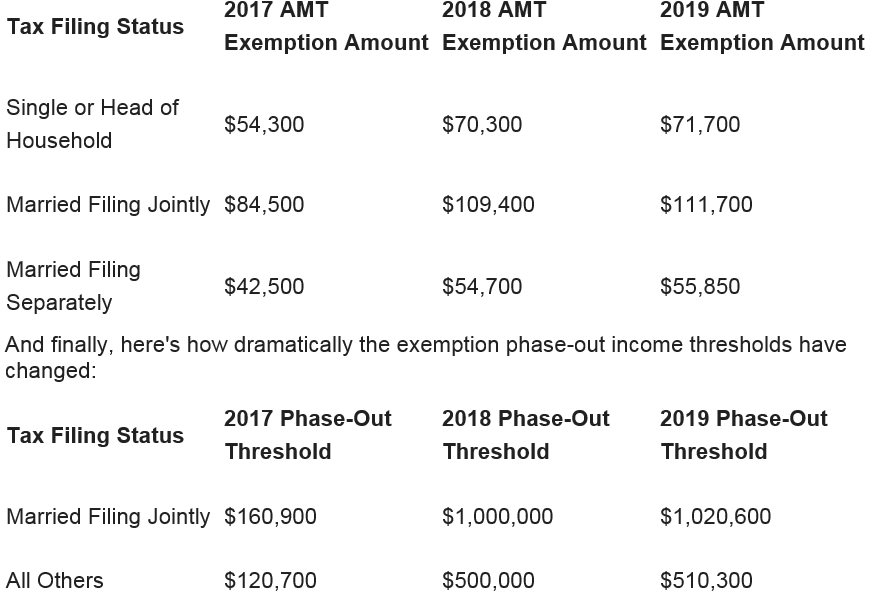

Second, the amount of the AMT exemption itself, as well as the phase-out limits at which they begin to move away, is greatly increased. A look at the AMT exemption for the 2017-2019 tax years:

Property tax now applies to lower American families as well

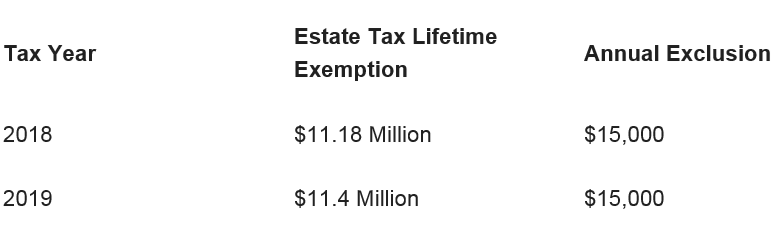

To be perfectly clear, the estate tax, which is basically a tax on inherited property, applies only to the wealthiest American families, before the tax cuts and jobs act was passed. However, the new law applies it to even fewer filers.

Under pre-tax law, the estate tax only applies to the portion of a property that was over $ 5.59 million (2018). The new law doubled the threshold to $ 11.18 million for 2018 and will increase again in 2019.

Which tax cuts have been made?

As we have seen, many tax cuts survived the passage of the Tax Cuts and Jobs Act, either in their previous form or with amendments. On the other hand, there are some that are not meant to be on the books. Remember, the goal of the tax reform effort was not just to cut taxes, but to simplify the US tax code. As part of the simplification, many cut axes.

Here are the most important tax breaks that Americans can no longer take advantage of:

Moving expenses - This was an aforementioned deduction, meaning that it may or may not be charged to a taxpayer, and was designed to offset the cost of moving expenses related to the job. Now, this deduction is gone, except for a few moves related to active-duty military service.

Casualties and theft losses - If your house was burglarized, you were able to cut the value of previously stolen items. Now, the deduction can only be used to make up for losses declared by the union.

"Miscellaneous Deduction" Category - This is a correct simplification for the tax code. There used to be a long list of cuts that Americans could take advantage of, to the extent that they were over 2% of AGI. This includes unrestricted employee expenses, tax preparation expenses, and more. Starting with the 2018 tax year, these deductions are gone, so some taxpayers with a lot of these expenses may feel stinged by it.

Which tax breaks will be in 2019?

As I mentioned, many tax breaks survived the Tax Cuts and Jobs Act. This is not a complete list, but here are some tax deductions and credits that were not affected at all:

Capital Gains and Qualified Dividend Tax

The Child and Dependent Care Credit

American Opportunity Credit

Lifetime learning credit

Student loan interest deduction

Tax deduction for retirement savings

Will these tax changes expire after 2025 or will Congress make them permanent?

A major uncertainty is what will happen to the tax code after 2025. The way the Tax Cuts and Jobs Act is established, changes to the corporate side of the tax code are permanent, but are set to expire after individual tax changes in the 2025 tax year. The most significant exception is the change from CPI-W to chained CPI to calculate inflation - this is a permanent change.

Here is the problem. If the tax change expires after 2025 and our personal tax code reverts to its previous form, the low inflation calculation would effectively overstate the taxes it previously held for most Americans.

An effort is currently underway to make the change permanent (lawmakers refer to it as part of "tax reform 2.0"). However, with a divided Congress, any other tax bills could face a tough fight.

Like to digest? Don't fret

Of course, these changes may seem a bit complicated. However, the good news is that if you use tax preparation software or are your tax professional, you do not have to worry too much about them. They will ensure that you are following the code by updating and calculating the impact of these changes on your wallet.

Something big happened

I don't know about you, but I always pay attention when one of the best growth investors in the world gives me a stock tip. Motley Fool co-founder David Gardner and his brother, Motley Fool CEO Tom Gardner, just revealed two brand new stock recommendations. Together, they have quadrupled the return of the stock market in the last 17 years. * And while time is not everything, the history of Tom and David's stock pics shows that it pays to arrive early on their ideas.

Tax Changes:

Everything You Need to Know

Americans need to know these important differences in tax law before filing their tax returns this spring.

The Tax Cuts and Jobs Act is the most important set of changes in the US tax code over several decades. Most of the changes go into effect for the 2018 tax year, which you will file with the IRS in the spring of 2019.

Here's what Americans need to know about recent tax changes, which could affect individual taxpayers in the upcoming tax season. Changes made by the corporate will not affect your tax return, so we will focus on the individual filer. These changes, which are mandated by the new tax law for individual filers, are set to expire in 2025, unless they are extended. (Corporate changes made to the bill are permanent.)

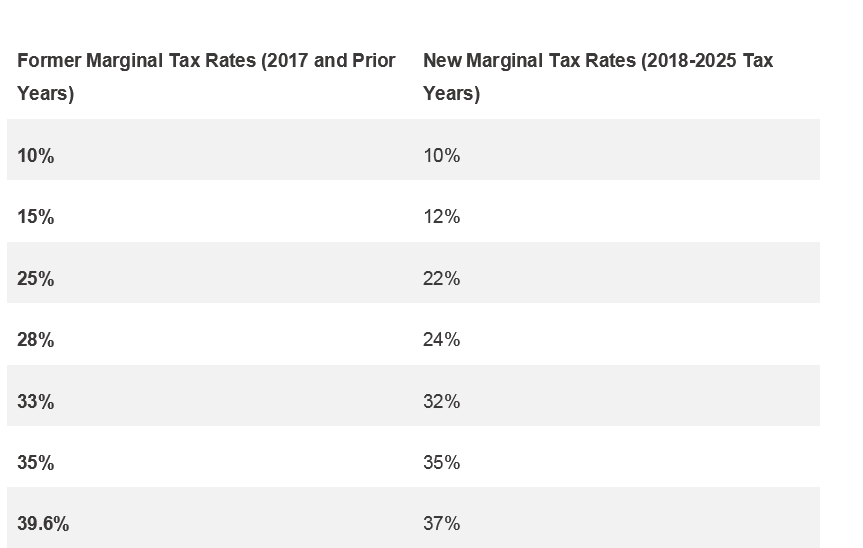

Tax brackets - Still seven, but with different rates

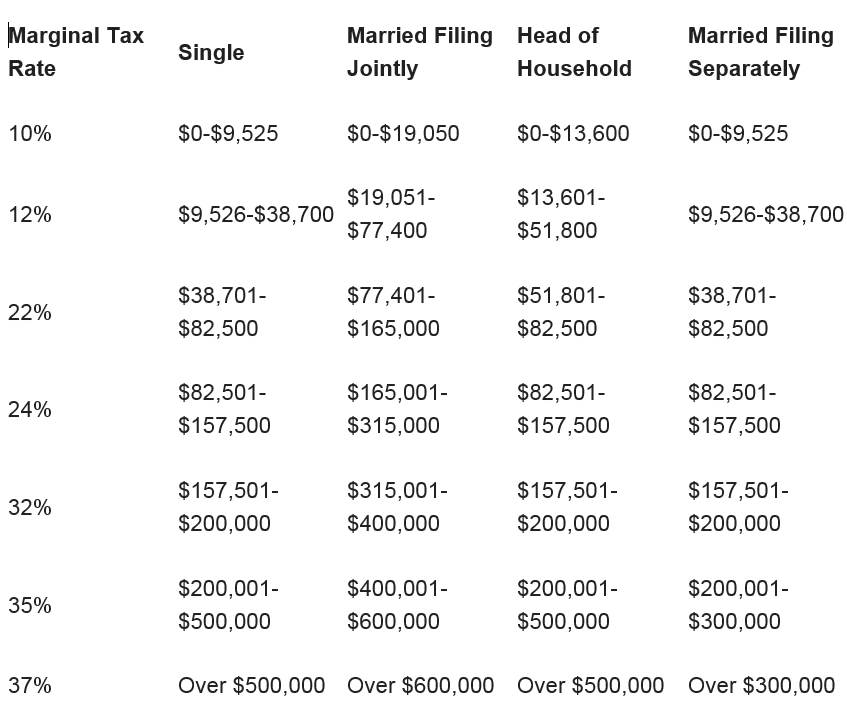

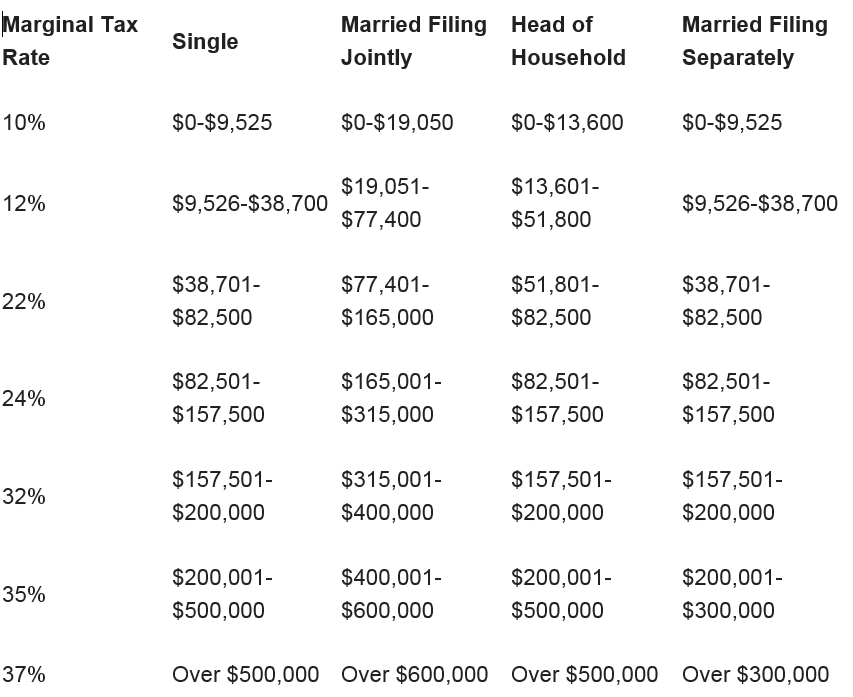

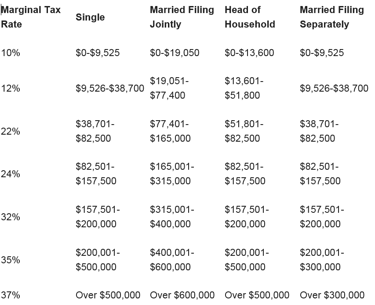

One of the main changes made by the Tax Cuts and Jobs Act was the general lowing of US tax rates. While the number of tax brackets remained at seven, the rates were typically reduced, with the exception of the lowest tax rate remaining 10% for the poorest Americans.

In addition to lower tax rates, income limits were increased, especially in higher tax brackets. In other words, the highest tax brackets now apply to lower (higher-earning) Americans than they did before. For example, before the passage of the Tax Cuts and Jobs Act, the top tax rate was 39.6% and applied to married couples filing jointly who earned more than $ 480,050. With the tax reform, that peak rate was reduced to 37% and applies to married couples making more than $ 600,000 in taxable income, higher income than before.

Here's a look at the tax brackets for the 2018 tax year, which will apply to the next tax return you file in 2019.

Additionally, the IRS announced the recently updated inflation-adjusted 2019 tax brackets, which you will use on the tax return filed in 2020 for income earned during the 2019 calendar year: